Berkley City Manager Matt Baumgarten reviews the details of a millage proposal for a Headlee override with residents at an informational meeting April 12 at City Hall.

Photo by Mike Koury

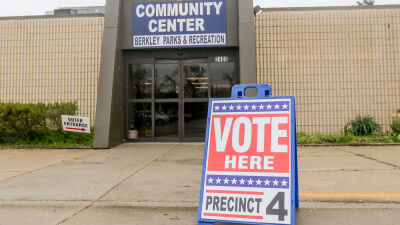

BERKLEY — Berkley residents will have a big question to answer when they go to the polls for the May 2 election.

Residents will have a choice on their ballots of whether to approve a millage proposal for a Headlee override.

In the lead up to the vote, Berkley held multiple informational meetings to provide an overview of the millage and to answer questions from residents.

According to City Manager Matt Baumgartern, the city is asking residents to restore Berkley’s millage rates, specifically for its operating and police/fire mills, by a total of 3.4581 mills and return the millage back to the original 13 mills.

Baumgarten said during an April 12 informational meeting that 3.46 is the number of mills the city has lost since voters’ last millage vote in 2012. The millage currently stands at around 9.54 mills.

“It is an increase. We’re not hiding that. We think we can add value to the city,” he said. “I don’t want anybody going into the ballot box mistakenly thinking that voting yes for this is just carrying over what they had in the past. We are asking to reset that number.”

If approved, the millage would go into effect on the summer 2023 tax bill and would raise approximately $2,550,000 when it’s first levied.

Baumgarten told the Woodward Talk that Berkley is going for the millage now because the city is in a cycle when it comes to its millage where it will get raised and eventually decrease over time.

“In (2012), we went to the voters, we asked to go back up, that number ticked down, you decided what your bottom is when you get to the point where you can’t necessarily afford all the services that people like,” he said. “At that point, you ask to go back up and then it ticks down and then you’ll get to the point again where you can’t necessarily afford the services that people like. So we’re to the point now, we’re at the bottom of that cycle, and so that’s why we feel like it’s time to ask the voters to go back up to the top of that cycle and then watch it tick down again over the years.”

Baumgarten said the city doesn’t want to take the next step of cutting back services it provides, which is why the city is asking the voters this question now.

Services that Baumgarten cited in his presentation that would be affected in the first year include curbside leaf collection; the replacement of several Department of Public Works trucks and equipment; improvements to the Community Center, which includes replacement of the front doors and roof updates; heating, ventilation, air conditioning and other building updates to the public library; and city facility improvements.

“Before we get there, it’s the right time to ask the voters, ‘Hey, you know, conceptually you get the government you fund. Are these things worth funding for you, or do we need to have a different way of offering these services at a lesser instance or less frequency or less quality?” he said.

Rich Humphrey, a 45-year resident of Berkley, attended the informational meeting, and while he said it was factual in what the issue is about, he’s still not happy about a potential raise to his taxes.

Earlier that day, Humphrey turned in his absentee ballot for the May election, and while he declined to state how he voted on the millage, the increase in money he would pay, which he said was about $300 a year, was the biggest factor in his decision.

“It’s a tough time to ask,” he said. “Maybe if they’d spread it over a few years, it might have been a little easier to swallow. Can my wife and I afford it? Yeah. Do we want to afford it? No, because everything’s gotten expensive, inflation is high, the government’s putting money and spending money like a drunken sailor. And where’s it going to stop? … It’s a pretty hard time to ask for money.”

Cindy Berry, a 12-year resident, wasn’t happy about the millage increase either and felt a lot of people are going to be surprised by what’s going to hit them if the vote passes, because they haven’t taken their time to figure out their assessed value. Berry said her payment will increase $326 a year.

“They haven’t come to us and asked for anything because inflation has been zero,” she said. “But now inflation has gone up for everybody. Their costs have gone up, so they need to ask for this, but they’re asking, to me, they’re asking way much more in excess of what they’ve been operating with in the past.”

The ballot language reads, “Shall the limitation on the amount of taxes which may be imposed on taxable property in the City of Berkley, Michigan be increased by 3.4581 mills ($3.46 per thousand dollars of taxable value), beginning in 2023 as new additional millage in excess of the limitation imposed by Michigan Compiled Laws section 211.34d, to restore City Charter millage authorization previously approved by the electors as reduced by operation of the Headlee amendment, to provide funds for municipal operating purposes, including police and fire services? It is estimated that 3.4581 mills would raise approximately $2,550,000 when first levied in 2023.”

For a home with a taxable value of $100,000, the millage increase would be $346.

Residents can determine their increased payment by visiting www.berkleymich.org/millagecalculator. Presentation slides from the informational meetings can be found under the “2023 Millage” tab at www.berkleymich.org.

Publication select ▼

Publication select ▼